In the financial services sector, the disclaimer that is used the most is “Past performance is no guarantee of future results.”

Investors are being cautioned not to become overexcited about what they perceive to be a recurrence of a past pattern. Because history frequently does not repeat itself.

Nevertheless, if the past is any guide to the future, the fall of 2022 may signal the conclusion of the months-long selling that drove the S&P 500 down by almost 25% between its high on January 3 and low on October 12.

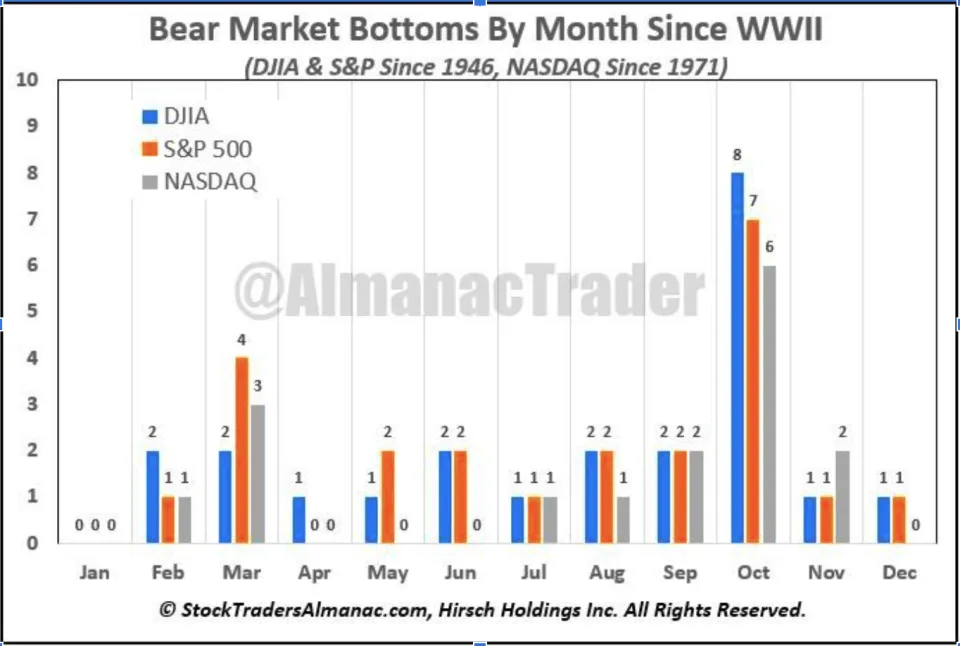

Ari Wald, head of technical research at Oppenheimer, observed last month that “major market bottoms have occurred in October more than any other month.”

On social media, charts like the one from Jeff Hirsch of Almanac Trader below have been frequently shared.

“Not all indices have bottomed on the same day for all bear markets, but the lion’s share, or bear’s share I should say, bottomed in October,” Hirsch wrote.

The performance of stocks during the midterm elections is another noteworthy statistic that has been mentioned.

Jim Reid, the global head of credit strategy at Deutsche Bank said last week, “[T]he S&P 500 has risen in the year after every single one of the 19 midterm elections since World War II, with not a single instance seeing a negative return.”

Democratic control of the Senate and/or the House could be lost in this year’s crucial election on November 8, which would raise the possibility that little new legislation would pass amid the impasse. Ironically, because it reduces policy uncertainty, deadlock is frequently seen as a positive for markets.

To restate, none of this indicates that a protracted market rally will start this fall. Particularly this year has been exceptional because the Federal Reserve has been openly depressing markets in an effort to reduce inflation. Additionally, inflation is still consistently high.

This article was originally posted here.